Housing Loan

7.35% P.A*

Apply Now!

At The Gurgaon Central Cooperative Bank Ltd., we prioritize the security of our customers' financial transactions. To prevent cheque fraud and unauthorized transactions, we have implemented the Positive Pay System (PPS) as per the guidelines of the Reserve Bank of India (RBI). This system ensures that high-value cheques are processed securely and efficiently under the Cheque Truncation System (CTS).

The Positive Pay System (PPS) is a mechanism to verify high-value cheques before they are cleared by the bank. Under this system, customers issuing cheques above a specified amount must share cheque details with the bank before submission. This ensures that only authorized cheques are honored, preventing fraud and unauthorized alterations.

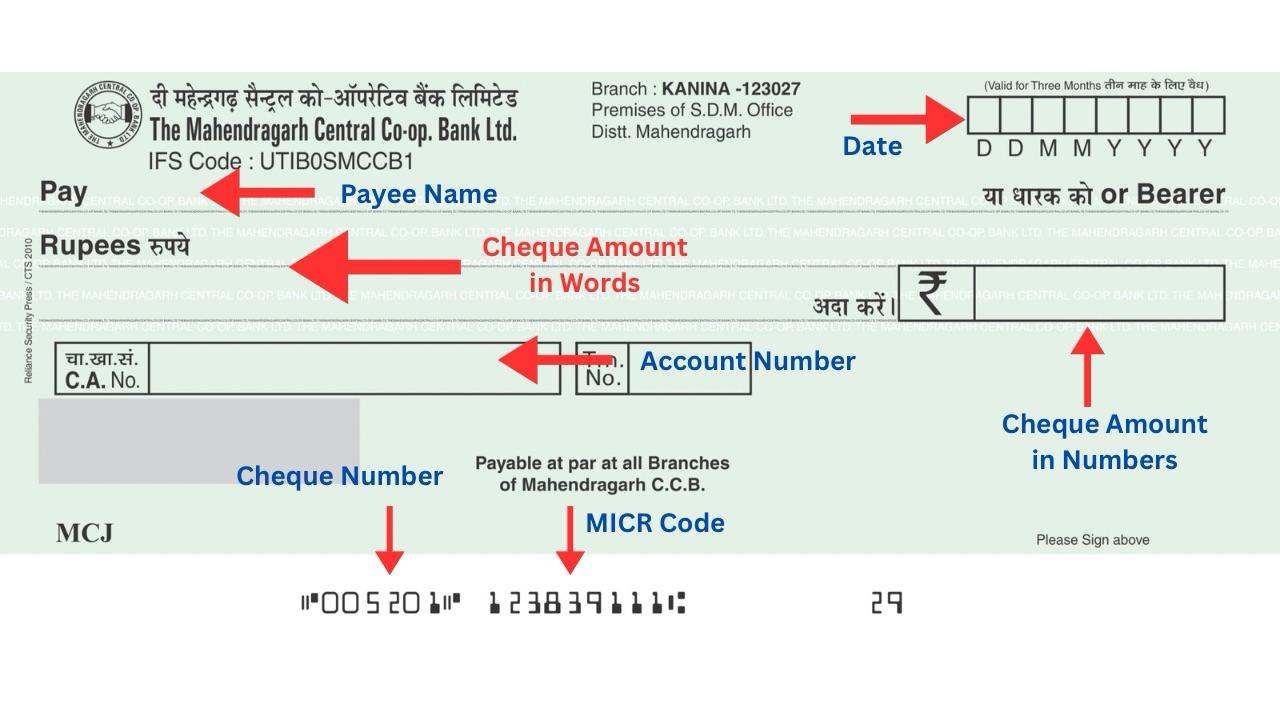

Customer Issues a Cheque:

Submit Cheque Details to Bank:

Bank Verifies the Details:

Cheque Clearance:

Customers can register for PPS using the following methods:

For further details on the Positive Pay System (PPS) or assistance with registration, visit your nearest The Gurgaon Central Cooperative Bank Ltd. branch or contact our Clearing Customer Support at +91 83768 01200.

Your Security is Our Priority!